Inheritance and tax codes: how to complete the F24 form

The complete guide to inheritance payments, editable online F24 form

The Revenue Agency has introduced a series of dedicated tax codes for the payment of taxes related to inheritance tax returns. This is an important step, as it allows taxpayers to make payments using the F24 form, thus aligning the payment methods with those already in place for most state taxes.

The Agenzia delle Successioni has compiled all the tax codes for payments related to the inheritance tax return in this article. The Italian Revenue Agency issued provisions on this matter on March 25, 2016, and January 10, 2025, with resolutions and the establishment of dedicated tax codes. The tax codes listed below were taken from these two directives, which clarified the situation.

The digitalization of inheritance declarations has also allowed citizens, at the time of filing, to indicate an IBAN code to which the cost of inheritance taxes will be automatically debited.

For paper-based, corrective, amending, late, supplementary, and other types of successions, it is advisable and often mandatory to proceed with a dedicated payment using form F24, indicating one or more of the relevant tax codes found below.

If necessary, you can take advantage of the advice or services of the Agenzia delle Successioni by simply filling out the form.

- Editable online F24 form

- Instructions for completing the F24 form - taxpayer section

- Here are the tax codes on the subject of succession

- Tax codes for inheritance tax payment notices

- Spontaneous payments by definition for acquiescence

- Definition of penalties for inheritances only

- Verification with adhesion

- Judicial conciliation of inheritance taxes and penalties

- Calculate inheritance tax to be entered in the F24 form

- Is it possible to deduct the cost of the inheritance from your taxes?

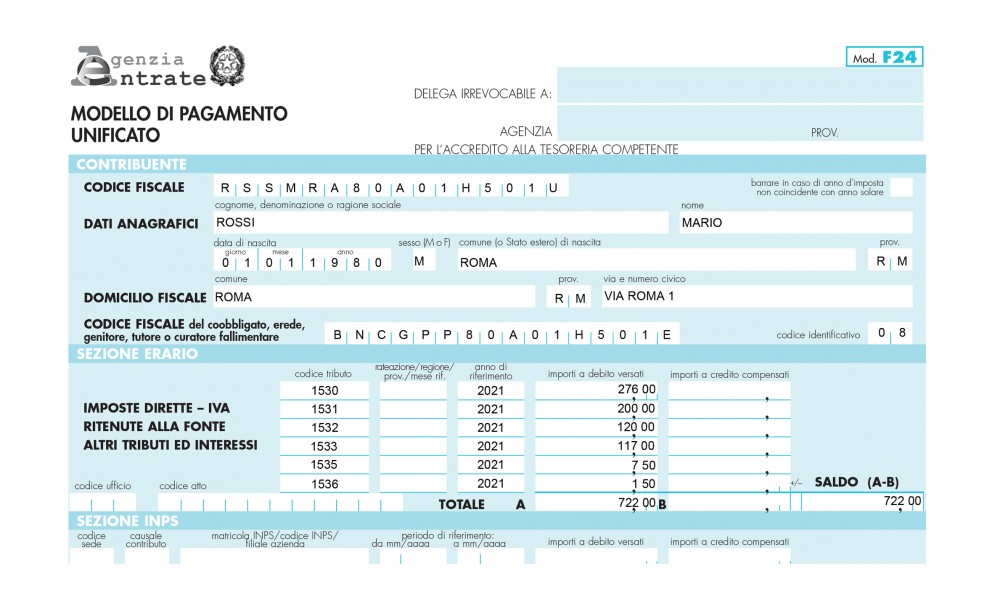

Editable online F24 form

To make it easier to fill out the F24 form, the Agenzia delle Successioni has made an editable online form available to its users free of charge . You can download it by scrolling down to the bottom of this article. After downloading the editable file, you can fill it out by following the instructions below.

Typically, the office code and deed code fields are not required, nor are the offset credit amounts and other subsequent sections up to the end of the document, unless otherwise required. Finally, the date must be entered in the "Payment Details" section at the bottom, indicating the date of payment.

You can enter your IBAN details if you have them at the bank.

It must be printed in triplicate and signed on each page. That is:

- 1st copy for the bank/post office/collection agent

- 2nd copy for the bank/post office/collection agent

- 3rd copy for the person making the payment

Instructions for completing the F24 form - taxpayer section

In the first phase of the form, the details of the heir making the payment must be entered, as follows:

- Tax ID code

- Surname

- Name

- Date of birth

- Sex

- Municipality of birth (or foreign state)

- Province of birth

- Municipality of residence (tax domicile)

- Province of residence

- Street and house number of residence

To complete the first section of the F24 form, you must enter the deceased's tax code and the identification code 08, which is located next to it. The tax code entry field is located after the words "tax code of the joint debtor, heir, parent, guardian, or bankruptcy trustee."

Once the taxpayer section has been completed, the Treasury section must be filled in, identifying the correct tax code, which is listed below.

Here are the tax codes on the subject of succession

- 1530 - Inheritance - Mortgage Tax

- 1531 - Successions - Land Registry Tax

- 1532 - Successions - Taxes for mortgage and land registry services

- 1533 - Inheritance - Stamp duty

- 1534 - Successions - INVIM substitute tax

- 1535 - Inheritance - Penalty for voluntary disclosure - Mortgage and land registry taxes and duties, and inheritance tax - Article 13 of Legislative Decree No. 472/1997

- 1536 - Inheritance - Penalty for voluntary disclosure - Stamp duty - art. 13, Legislative Decree no. 472/1997

- 1537 - Successions - Interest on voluntary disclosure - art. 13, Legislative Decree no. 472/1997

- 1539 - Inheritance - Inheritance tax - self-assessment

- 1549 - Successions - Late filing of the inheritance tax return - Penalty for rectification - Inheritance tax - Article 13 of Legislative Decree No. 472/1997

- 1567 - Public Acts - Taxes for mortgage and land registry services

- 1635 - Inheritance - Inheritance tax - Interest on installment payments

Regarding the second column, if left blank, the payment must be made in full.

If the taxpayer, if permitted by current legislation and the citizen falls within the categories, may defer payment, following the usual method. Specifically, the data must be entered in NNRR order. NN represents the number of the installment being paid, and RR indicates the total number of installments to be paid. For example:

- F24 0112

- F24 0212

- F24 0312 and so on

Once the correct tax codes to enter in the F24 form and any installment plans have been identified, the reference year is entered in the third column. The reference year should always be the year of death, in YYYY format (e.g., 2023). Specifying the correct year facilitates the allocation of the payment to the deceased's estate. If there is a discrepancy, we recommend contacting the relevant office to ensure the correct allocation.

Tax codes for inheritance tax payment notices

When the Office issues a notice of inheritance liquidation, the taxpayer must use one of the various codes present in this series, always using the F24 form:

- A139 - Inheritance - Inheritance tax penalty - Notice of tax payment - Art. 33, paragraph 3, of the TUS

- A140 - Inheritance - Mortgage Tax - Notice of Tax Liquidation

- A141 - Inheritance - Land Registry Tax - Notice of Tax Payment

- A142 - Public deeds - Successions - Fees for mortgage and land registry services - Amounts paid by the office

- A143 - Successions - INVIM substitute tax - Notice of tax payment

- A144 - Successions - INVIM Treasury - Notice of tax liquidation

- A145 - Successions - INVIM Municipalities - Notice of Tax Liquidation

- A146 - Inheritance - Stamp Duty - Notice of Tax Payment

- A147 - Successions - Inheritance tax - Notice of tax liquidation

- A148 - Inheritance - Stamp duty penalty - Notice of tax payment

- A149 - Inheritance - Mortgage and land registry tax and duty penalties - Tax payment notice

- A150 - Successions - Penalty for late submission of the succession declaration - Notice of liquidation - Art. 50 of the TUS

- A151 - Successions - Special taxes and fees - Notice of tax payment

- A152 - Inheritance - Interest - Tax Liquidation Notice

Spontaneous payments by definition for acquiescence

To enable the payment of the amounts due requested with a notice of assessment or liquidation, the taxpayer must use one of the following codes:

- A153 - Successions - Inheritance tax and related interest - Failure to appeal

- A154 - Inheritance - Mortgage tax and related interest - Failure to appeal

- A155 - Successions - Land Registry Tax and Related Interest - Failure to Appeal

- A156 - Inheritance - Stamp duty and related interest - Failure to appeal

- A157 - Successions - INVIM substitute tax and related interest - Failure to appeal

- A158 - Successions - INVIM Treasury and related interests - Failure to appeal

- A159 - Successions - INVIM Municipalities and related interests - Failure to appeal

- A160 - Inheritance - Stamp duty penalty - Failure to appeal

- A161 - Inheritance - Mortgage and land registry tax penalties - Failure to appeal

- A162 - Successions - Inheritance tax penalty - Failure to appeal

- A163 - Successions - INVIM Sanction - Failure to Appeal

- A164 - Successions - Special taxes and fees - Failure to appeal

Definition of penalties for inheritances only

To allow the payment of sums due as a result of penalties in inheritance matters following an assessment or liquidation notice from the offices, the following codes must be entered:

- A165 - Inheritance - Stamp duty penalty - Definition of penalties only

- A166 - Inheritance - Mortgage and land registry tax penalties - Definition of penalties only

- A167 - Successions - Inheritance tax penalty - Definition of penalties only

- A168 - Successions - INVIM Sanction - Definition of sanctions only

Verification with adhesion

In the case of assessment with acceptance on assessment or liquidation notices issued by the offices, payments must be made using the following codes:

- A169 - Successions - Inheritance tax and related interest - Assessment by agreement

- A170 - Inheritance - Mortgage tax and related interest - Assessment by agreement

- A171 - Successions - Land registry tax and related interest - Assessment by agreement

- A172 - Inheritances - Stamp duty and related interest - Assessment by agreement

- A173 - Successions - INVIM substitute tax and related interest - Assessment with acceptance

- A174 - Successions - INVIM - Treasury and related interests - Assessment with adhesion

- A175 - Successions - INVIM Municipalities and related interests - Verification with adhesion

- A176 - Inheritance - Mortgage and land registry tax penalties - Assessment by agreement

- A177 - Successions - Inheritance tax penalty - Assessment by agreement

- A178 - Inheritance - Stamp duty penalty - Assessment with acceptance

- A179 - Successions - INVIM Sanction - Assessment with acceptance

- A180 - Successions - Special taxes and fees - Assessment by agreement

Judicial conciliation of inheritance taxes and penalties

When the settlement of taxes and penalties in the area of ??inheritance occurs in conciliation, the following codes are used:

- A181 - Successions - Inheritance tax and related interest - Judicial conciliation

- A182 - Successions - Mortgage tax and related interest - Judicial conciliation

- A183 - Successions - Land Registry Tax and Related Interest - Judicial Conciliation

- A184 - Successions - Stamp duty and related interest - Judicial conciliation

- A185 - Successions - INVIM substitute tax and related interest - Judicial conciliation

- A186 - Successions - INVIM Treasury and related interests - Judicial conciliation

- A187 - Successions - INVIM Municipalities and related interests - Judicial conciliation

- A188 - Inheritance - Mortgage and land registry tax penalties - Judicial conciliation

- A189 - Successions - Inheritance tax penalty - Judicial conciliation

- A190 - Inheritance - Stamp duty penalty - Judicial conciliation

- A191 - Successions - INVIM Sanction - Judicial Conciliation

- A192 - Successions - Special taxes and fees - Judicial conciliation

As stated above, this article refers to AdE resolutions No. 16/E of 2016 and No. 2/E of 2025. Any further updates after the publication date may not be reflected in this text. Please refer to the applicable regulations for further details. This content is for informational and educational purposes only.

Calculate inheritance tax to be entered in the F24 form

Inheritance taxes are calculated using specialized software, capable of precisely quantifying the amounts owed to the state. These amounts must be reported in the fourth column of the Treasury section of the F24 form.

The calculation is drawn up taking into account multiple factors including the cadastral value, the degree of kinship, the shares, etc.

To ensure accurate completion of the F24 form and the entire procedure, it is always advisable to rely on qualified professionals, such as those at the Agenzia delle Successioni, who can guide you through each phase with expertise and confidence.

Is it possible to deduct the cost of the inheritance from your taxes?

One of the questions that many users ask us concerns the possibility of deducting the cost from their tax return.

The answer is no. The bureaucratic costs of the inheritance declaration are not tax deductible for private citizens/heirs.

The rules may change in cases involving inheritance of a business or the business inheriting assets. Every succession, whether complex or otherwise, always requires prior study to avoid errors and penalties. You can book a preliminary consultation with a professional by filling out the form.

Customer Service

Customer support is available Monday to Friday, from 9:00 AM to 5:00 PM.

Fill out the Form

Consult the expert professional in the field

Fast response and personalized assistance!